Free bank compliance training

Want to make sure that your team is bank compliant? Use our free training platform to deliver a ready-made bank compliance course straight to your learners’ devices.

Brand our ready-made bank compliance courses

Make ready-made training feel like your training. Customize our bank compliance courses to jumpstart your compliance training.

Free editable courses for your bank compliance training

Build your free bank compliance training today!

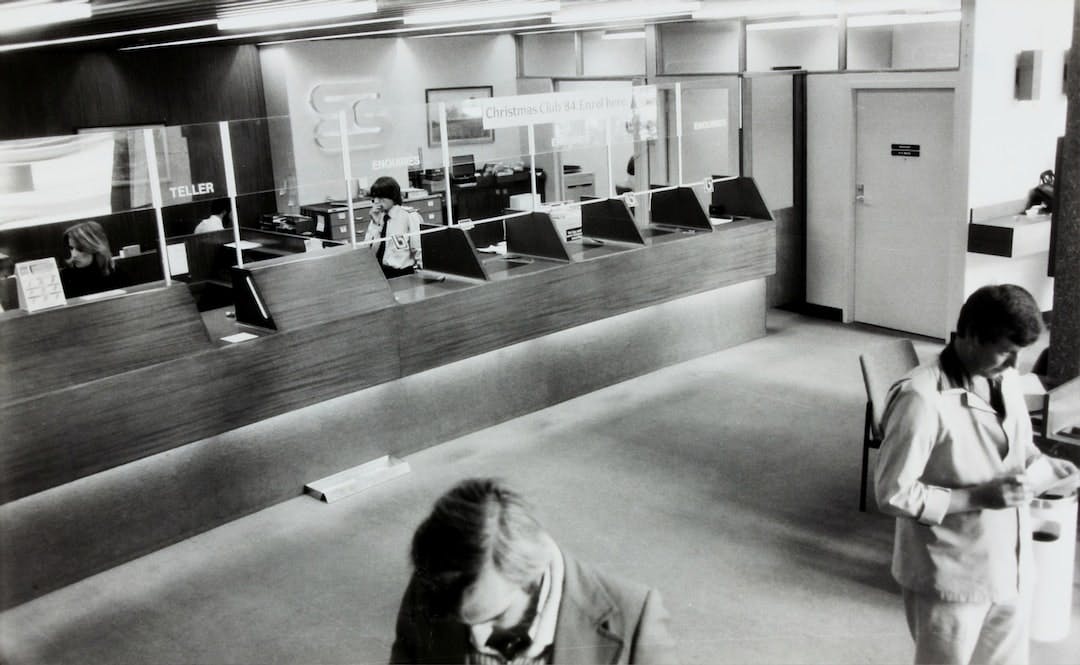

What is bank compliance training?

Bank compliance training is a series of courses that banks and other financial institutions use to educate their employees on the latest compliance regulations. The training covers a wide range of topics, including anti-money laundering, consumer protection, and risk management.

By offering this training to their employees, banks and financial institutions can rest assured that their employees are up-to-date on the latest compliance regulations and that they understand how to comply with these regulations. And the good news? SC Training (formerly EdApp) offers bank training online – for free.

Why is bank compliance training important?

Banks are required by law to follow certain compliance regulations, and it’s important for employees to receive training on these regulations. Bank compliance training helps make sure that your team understands the compliance requirements and knows how to comply with them.

Additionally, bank compliance training can help prevent compliance violations, which can result in fines and other penalties for the bank. It can help protect the bank's reputation by making sure that employees are aware of the compliance requirements and are following them.

What are the topics covered in a bank regulatory compliance training?

To give the best compliance training possible, many banks make an effort to offer free online compliance courses to their employees. These free courses typically cover topics such as the Bank Secrecy Act, Anti-Money Laundering (AML) regulations, know-your-customer (KYC) requirements, and the USA PATRIOT Act.

Many bank regulatory compliance training courses also offer training on identifying and reporting suspicious activity, as well as Bank Secrecy Act recordkeeping requirements. Additionally, banking compliance officer certification can also discuss the importance of compliance and the potential consequences of violating banking regulations.

Who needs bank compliance training programs?

Organizations that fall under the Bank Secrecy Act (BSA) are required to give compliance training to their employees. The Act covers a broad range of financial institutions, from banks and credit unions to money service businesses and casinos.

Even non-financial businesses may be subject to the BSA, especially if they need to increase their security practices to prevent illegal activities such as money laundering or terrorist financing.

Employees who are able to complete bank compliance certification will be better equipped to identify red flags and report suspicious activity. This gives them an edge to better serve their customers and avoid penalties for non-compliance.

What are the benefits of taking bank compliance training online?

Many organizations choose to use online compliance training courses in order to save time and money. These courses can be taken at the employee’s own pace and can be customized to fit the organization’s specific needs.

Organizations that give their employees online bank compliance training can expect more benefits in the future. These benefits include:

- Protection from financial losses that could occur as a result of employees violating banking regulations.

- Established sense of trust and confidence in the organization among its employees, customers, and other stakeholders.

- Guaranteed compliance with legal and regulatory obligations

- Skilled and knowledgeable team that can identify potential risks and compliance issues within the organization.

What are the different types of bank compliance training?

For small organizations, basic compliance training may be enough. It’s typically delivered through e-learning modules or in-person training sessions.

For larger organizations, more comprehensive training is typically required. This training is often delivered through a combination of e-learning modules, in-person training sessions, and on-the-job training.

You should choose a compliance training solution that’s tailored to the specific needs of your organization. The type of training required will depend on the size and structure of the organization, as well as the compliance risks faced.